Have the New Export Regulations Increased Exports?

The most interesting question for the year just ended is whether the implementation of new export regulations for non-military rifles, handguns and related ammunition on March 9, 2020, has led to an increase in exports.

One objective of moving export control of non-military firearms and ammunition from the more restrictive jurisdiction of the State Department to the more exporter-friendly Commerce Department was to help U.S. firearm and ammunition exporters do better in the global market.

Exporters now can obtain export licenses that will cover several years of anticipated purchases by foreign end users, enabling them to ship orders more quickly. Also, after a learning curve, Commerce Department export licenses are much easier to prepare than State Department licenses.

In addition, an expensive annual registration is no longer required as a prerequisite to exporting and export licenses are free.

Have these changes produced an increase in exports?

At this point, it’s too soon to tell, probably way too soon, but it isn’t too soon to start looking at the data.

Here is what we have observed so far.

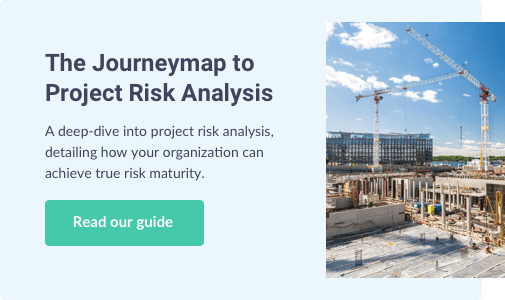

– Affected Product Categories

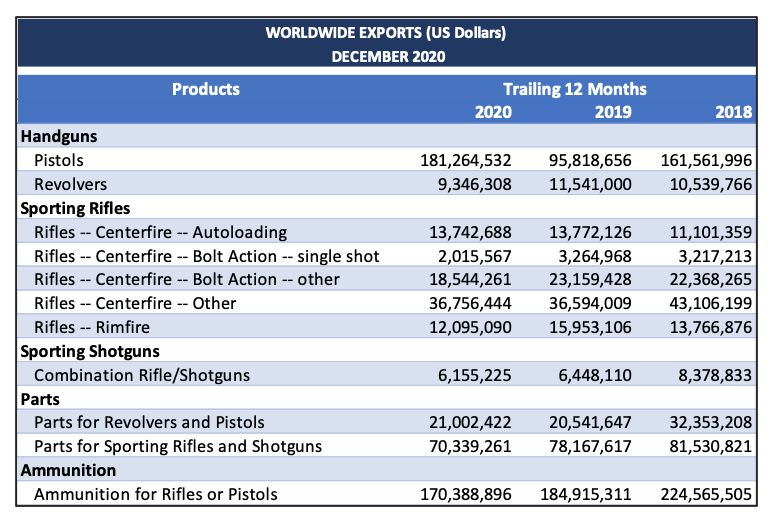

Of the 22 product categories we track, the 11 listed in the table below were significantly affected by the March 9, 2020 change in regulations. The products in these categories moved from the State Department to the Commerce Department.

These are the products to study if you want to investigate whether the new regulations have led to more exports:

– Have Global Exports Increased?

On a year-over-year basis, it isn’t possible to spot growth in the worldwide market during 2020 relative to the two previous years. For the 11 product categories affected by the new regulations, look at the table below:

The numbers go up and down from one year to the next with no discernible pattern, as has been the case historically.

This isn’t surprising. There were so many other significant forces at work in 2020. Some of them would have had a greater effect than the new regulations on exports of firearms and related products.

For example, the booming U.S. domestic market diverted product and manufacturers’ attention from international sales. Separately, the pandemic made it harder and more expensive to ship, negatively impacting export trade. Also, Canada banned ARs during 2020.

With so many other forces buffeting the global market in 2020, and most of them continuing to do so today, the ability to single out the impact of the new regulations won’t come anytime soon.

Representatives of the Commerce Department presented a slide at an NSSF-sponsored webinar in January 2021 that showed steady month-over-month growth in exports of firearms between March and September 2020. That is a positive sign, but, just like annual statistics, exports vary from month to month for many reasons.

– Growth May be Detectable in Exports to Certain Countries

It may be possible, however, to discern the impact of the new regulations by looking at specific markets.

At the same January 2021 webinar mentioned above, the Commerce Department representatives listed the leading destination countries in the export licenses they had processed for firearm items between March 9, 2020 and September 30, 2020.

Few would guess that Brazil topped the list. So, we added Brazil to our recurring monthly reports starting with this issue and took a look.

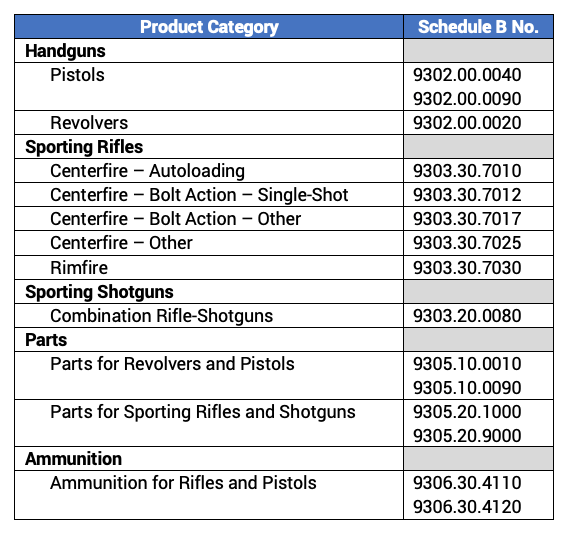

Sure enough, you can spot possible signs that the new regulations are causing trade to grow. Let’s examine the table below.

.png?width=677&name=Firearm-Exports-to-Brazil-2020%20(1).png)

Is this evidence that the new regulations helped stimulate trade? Could be. As noted above, Brazil also was the leading destination country, at least during the period measured, for Commerce Department export licenses. It should not be discounted either, that exports to Brazil show sign of growth when the global market as a whole does not.

Exports of pistols in 2020 were up 130% from 2018. Bolt action rifles was up by over 600% in the same period. Exports of ammunition for rifles and pistols grew more than 650%.

On the other hand, exports to Brazil of parts for non-military rifles and handguns were down by two-thirds from 2018 to 2020. See the highlighted row in the table above. Is this an anomaly, or is it evidence that the growth in other categories was a fluke?

Another factor is Brazilian President Jair Bolsonaro. Bolsonaro, who took office on January 1, 2019, liberalized Brazilian firearm ownership laws twice in 2019.

The combination of previously unmet demand in Brazil for American firearms, liberalization of Brazilian firearm ownership laws and exporter-friendly changes in U.S. regulations clearly has been good for U.S. export business to that country.

What share, if any, of the growth can be ascribed to the new regulations is anyone’s guess for now. Our guess, for what it’s worth, is that the new regulations are making a difference in the growth of lawful exports of firearms to Brazil.