Our Behind the Numbers analyses tend to focus on the civilian side of the international market for American firearms and related products.

This month we will look at exports to military end users.

What does the data tell us about military exports?

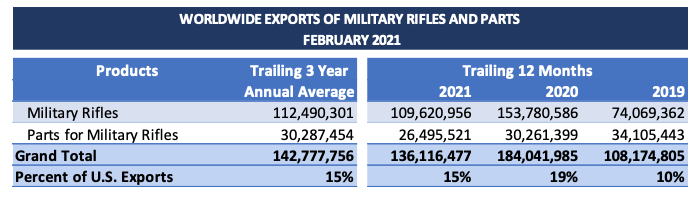

– Exports of military rifles and rifle parts are substantial

Table 1 shows that U.S. companies have exported an average of more than $142 million of military rifles and parts annually over the last 36 months. That constitutes about 15% of total exports for the 22 product categories we track.

– It is difficult to track military exports of several types of products.

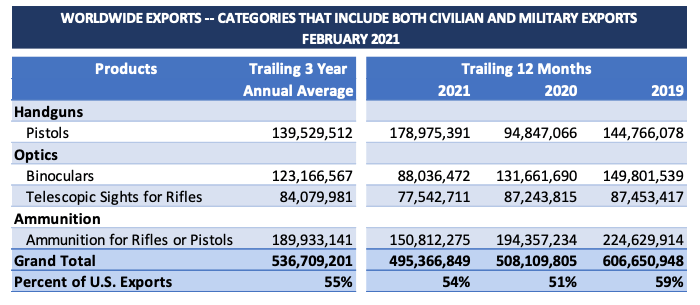

U.S. Schedule B numbers, which are the source of the data we report, do not distinguish between military and non-military exports of certain product categories, most notably pistols, optics, and ammunition. See Table 2.

Table 2 illustrates that the inability to distinguish between civilian and military exports in these four product categories is a significant analytical problem. Together, these categories account for more than half of annual U.S. exports of firearms and related products.

Not only is it impossible to quantify military exports of these products, but we can’t see the civilian component of this data, either.

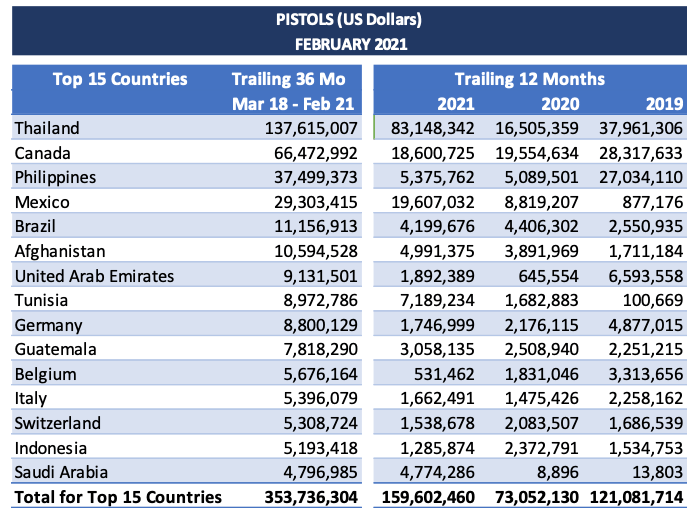

Table 3 drills down into one of the four product categories – pistols – and shows exports over the last 36 months to the top 15 destination countries. The second column from the left shows total exports of pistols during the 36-month period. The three columns to the right break that total into three 12-month periods.

For most of the top 15 destination countries in Table 3, there are wild fluctuations in exports from one year to the next. Years in which exports dramatically exceed exports in the preceding or subsequent year are the telltale sign of a significant military (or sometimes police) component to that year’s exports.

Look, for instance, at exports of pistols to Thailand during the 12 months that ended on February 28, 2021. Exports were more than five times the value of exports in the preceding 12-month period.

Look, for instance, at exports of pistols to Thailand during the 12 months that ended on February 28, 2021. Exports were more than five times the value of exports in the preceding 12-month period.

Our reports show every month that, even in purely civilian categories, like rimfire rifles, exports fluctuate quite a bit from year to year. But not that much.

Significant international purchases of military hardware from the U.S. tend to be “lumpy”. A buyer will place a large contract and will then expect the products to last a while. Those purchases show up in our reports as big blips in one period relative to the surrounding periods.

Table 3 reveals that, for most of the top 15 destination countries, foreign military procurements of pistols accounted for a high proportion of U.S. exports.

Police procurements, it is worth noting, are also lumpy, but there are many more law enforcement buyers, each buying smaller quantities at different times. As a result, it is generally much harder to spot exports to law enforcement agencies than to military end users.

– Imperfect data can still be useful

Good data enables U.S. exporters to make informed decisions where and how to deploy sales and marketing resources. How can imperfect data be turned into useful information?

One way to use the information in Table 3 is simply to recognize that if you currently export pistols to the international civilian market that are or could be attractive to military (and law enforcement) end users, you should consider broadening the focus of your international sales and marketing activities.

If, on the other hand, your primary focus is the military market, here is another way to use the information in Table 3.

Among the 15 countries covered in Table 3, the countries that have big “lumps” in one or more years can be identified as markets that are willing and able to buy U.S. pistols for military (or possibly police) purposes. Select those countries first for further investigation of potential opportunities for military or law enforcement sales.

Much more analysis needs to be done, but a case can be made for targeting countries that have a history of buying U.S. guns and related products. Countries that have made significant purchases of U.S. firearm-related products recently are likely to do so again.

Our monthly reports track the top 25 destination countries for each product category we cover, so a look at this month’s report (page 7 of the February 2021 issue of EasyExport Insights) will show you exports of pistols to the next 10 countries after the 15 shown in Table 3.

If you were to do your own data analysis (see page 43 of the February 2021 issue of EasyExport Insights for where we get our data; it is available to you, too), it would be useful to look at historical exports over the last 10 years as opposed to our three-year lookback. Doing so would help you identify additional countries that have purchased American pistols for military end use.

The same approach can be used with some of the other product categories in Table 2. It does not work with ammunition, which, as a consumable product, has different purchasing patterns from equipment.

So, even imperfect data can yield useful knowledge.